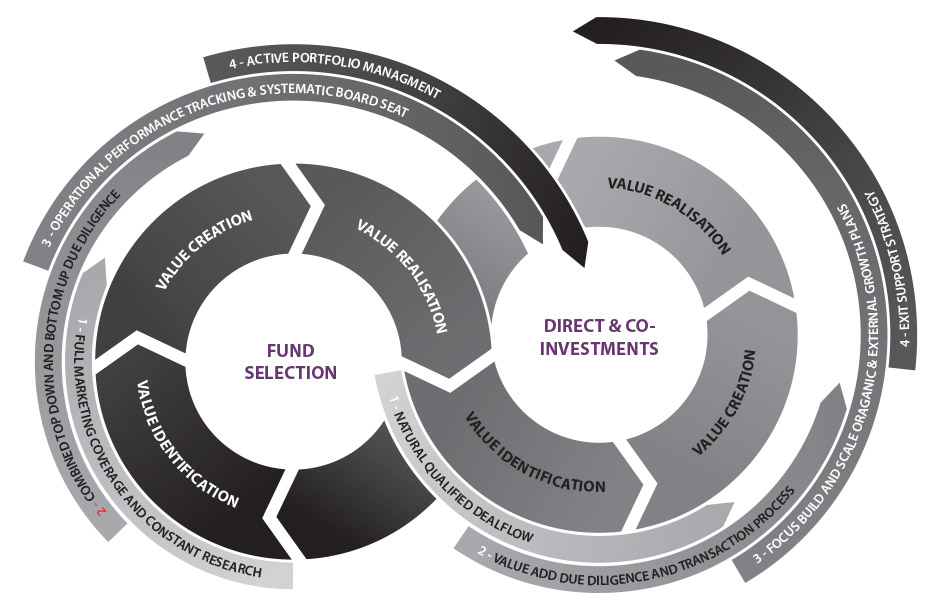

Access aims to deliver strong, consistent investment returns across economic cycles. It has a disciplined investment model to proactively originate and due diligence every stage of the investment process.

Fund

selection

Direct &

Co-Investments

The Smaller Buy-outs, Infrastructure and Private Debt markets consist of a large pool of players with varying degrees of experience and performance.

Access believes that a highly disciplined investment process is fundamental to produce strong and consistent returns. The expertise developed by Access in due diligence and fund selection over time, both on the primary and secondary markets, constitutes a strong competitive advantage. Access’ evaluation of potential investments involves the application of a consistent and comprehensive due diligence process placing a particular emphasis on the analysis of the operating performance of portfolio assets, performance benchmarking, sector dynamics evaluation, reference checks and negotiation of terms and conditions.

Through regular market screening and pro-active deal flow generation, Access provides an exhaustive coverage of these market segments in order to identify potential outperformers. Access’ investments professionals actively track a pool of more than 500 European private assets fund managers. Portfolio construction combines a top-down approach using optimal diversification across multiple dimensions with a qualitative bottom-up assessment of the underlying funds.

Advantaged by longstanding relationships with financial and industrial partners, Access is able to identify valuable niche opportunities underpinned by growth fundamentals across Europe.

With investing experience and a proven track record, the dedicated teams operate a selective investment process for joint control investments with co-investors. In order to select co-investment opportunities that offer superior value, Access’ dedicated co-investment teams apply, in addition to the work conducted by the lead investor, an additional layer of due diligence based on an independent analysis of the target asset.

Access is generally a top three investor in the primary underlying funds. The advisory board representation of Access on primary investee funds provides the team with strong risk control through deeper insight into the underlying fund managers and early involvement on any material issues during the lives of the funds.

Access is generally a top three investor in the primary underlying funds. The advisory board representation of Access on primary investee funds provides the team with strong risk control through deeper insight into the underlying fund managers and early involvement on any material issues during the lives of the funds.

Access seeks to obtain board seats, observer rights and/or other legal protections in order to control the value of its investments. During the holding period, the investment is pro-actively followed and value is through organic or external expansion plans.

Access seeks to obtain board seats, observer rights and/or other legal protections in order to control the value of its investments. During the holding period, the investment is pro-actively followed and value is through organic or external expansion plans.

risk

management

Access holds risk management as a constituent component in its corporate and investment activities, to operate in the investors’ best interest. A well-defined enterprise risk management framework has been developed to set out the roles and responsibilities for identifying, measuring and managing qualitative and quantitative risks inherent to the business operations.

Post-investment and during the lifetime of an investment program, Access dynamically manages investment risks. The investment teams continually monitor portfolios to ensure they are evolving in line with their objectives within the defined risk framework.