Established in December 1998, Access Capital Partners (“Access”) is an independent private assets manager, majority owned by its management, investing in the key economies of Western Europe.

Overview

Since inception, Access provides its clients with enhanced returns and reduced volatility for their private asset allocations.

Access’ integrated expertise offers exposure to Smaller Buy-outs, Infrastructure, and Private Debt through funds of funds, direct and co-investment funds and customised solutions. Building on its local presence in France, Germany, the United Kingdom, Benelux and the Nordic countries, the firm has gained extensive knowledge and coverage of the three market segments it targets in Europe.

The team is fully committed to integrating Environmental, Social and Governance best practices into its investment strategies, acknowledging that a responsible investment approach partially mitigates investment risk and enhances long term returns.

Corporate brochure

Corporate Social Responsability

KEY MILESTONES

| 1998 Access Capital Partners is founded |

1999 First Smaller Buy-out Fund of funds is launched |

| 2002 Access becomes a provider of tailored solutions to institutional investors through single client mandates |

2008 As a Responsible Investor, Access becomes a signatory of the UN-PRI |

| 2010 Access acquires Pohjola Private Equity Fund |

2011 Access launches its Private Debt activity |

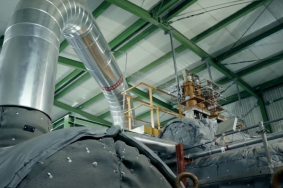

| 2013 Access establishes a dedicated Infrastructure investment activity |

2013 Access sets up an independent team for co-investments in Smaller Buy-outs |

| 2016 Access raises its first Infrastructure Fund of funds |

2017 Access raises its first direct Infrastructure Fund |

NEWS

& MEDIA

Press Releases 10.09.2024

Publications 10.10.2024